The finalized rate hikes for Con Ed customers across all five boroughs, as well as Westchester, come after the utility giant pushed for months to increase first-year total electricity revenue by $1.2 billion (11.2%) and gas by $503 million (18.2%) under its initial proposal.

New minimum pay rates for New York City app-based food - CBS News (1) $121.62 daily rate. In the California Labor Code, a regular workday is an eight-hour day. In situations in which there is only 1 employee on duty, the employee can eat on the job without being relieved as long as the employee voluntarily consents to the arrangement. An employee's regular rate is the amount that the employee is regularly paid for each hour of work. You might see double-time incentives offered for work on federal holidays, for overnight shifts, or, in rare cases, on weekends. Can I Sue My Employer For Not Paying Me Correctly? We owe healthcare professionals and hospital employees that have kept the doors open an enormous debt of gratitude for their work during this pandemic and this will move New York a small step in the right direction on compensation.. This vital agreement will increase overtime pay for our overworked health care professionals at SUNY hospitals and help to recognize them for their public service. Are Undocumented Workers Entitled To Overtime? The NYS Department of Labor is committed to ensuring that every hardworking New Yorker is paid the fair wages they deserve.

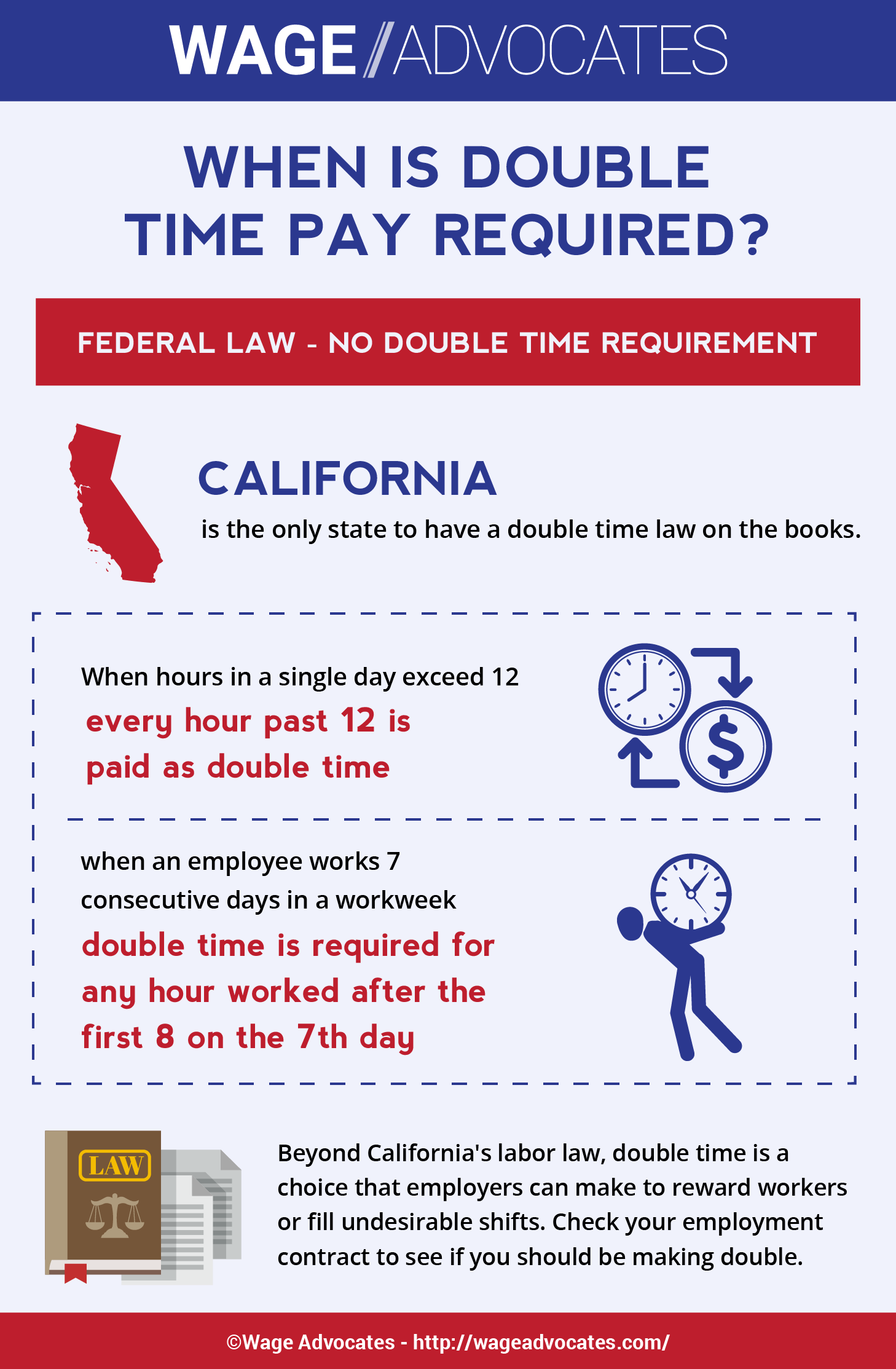

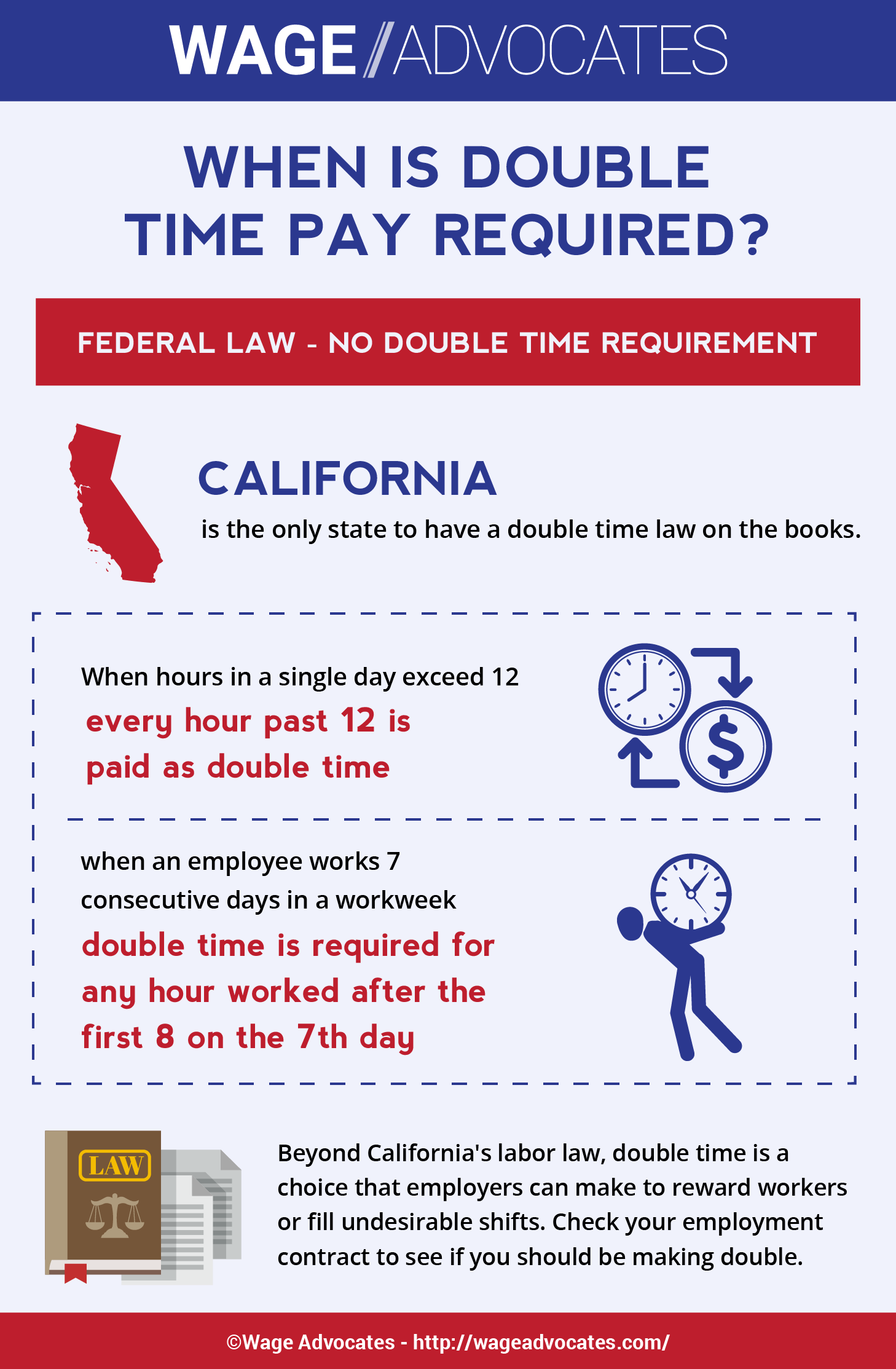

The Root of Haiti's Misery: Reparations to Enslavers - The New York Times It will repay customers more than $80 million. Now, for total hours worked over the week, the employee worked: We already know the employee is being paid double-time for some hours on the 6th and 7th days, and daily overtime for some hours throughout the week. $26.75 overtime rate (from step 3)x 16number of overtime hours in this example An employer who requires or permits an employee to work overtime is generally required to pay the employee premium pay for such overtime work. Minimum Wage Find your minimum wage and get your questions answered with fact sheets and dedicated FAQ pages for specific types of workers. Crypto taxes. The bank double-charged overdraft fees, withheld card perks and opened unauthorized accounts, regulators said. How long do I have to bring a wage claim under New York labor law? To arrive at Lucys overtime wage, all we need to do is multiply her regular rate of pay by one-and-a-half. (For a complete list ofAdditional Paymentsthat are included in the calculation of Overtime as of 3/1/2012). Rents in New York rose 33 percent between January 2021 and January 2022, according to the online listing site Apartment List, almost double the national rate and the highest increase among the 100 . An independent contractor is considered to be a worker who is contracted to do a specific job or work without the control, direction or supervision of the company. Since the typical overtime wage rate is1.5 timesyour regular rate of pay, this premium pay requirement has been given the nickname time-and-a-half.. California does have a double-time pay law, though. After that, you work seven consecutive days, ending on the next Tuesday. So how do you balance overtime and double-time in that case? For workers, that usually means time and a half or, in some cases, double pay. New York Labor Law requires employers to pay one and a half times your regular rate of pay (instead of your regular rate) for hours worked after 40 in a work week. For an additional $1 per play, "double play" gives players in select jurisdictions another chance to . Other breaks are generally not required; however, some industries do require a 24-hour rest period in each calendar week. A bridge between our web-based workforce management system and your payroll package. Time tracking technology frees you up to better run and grow your business. An employee whose regular pay rate is $15/hour works 5 days in a week. Our SUNY medical and hospital staff have been on the frontlines bravely battling the COVID crisis since the beginning and still continue their tireless and heroic fight every day for the patients they serve and we must do all we can to retain our workforce. The first chunk of time begins at Lucys first hour of work and ends at her eighth hour of work. So while California employees may receive daily overtime for hours worked beyond eight, this time must be subtracted from your calculations when determining any weekly overtime owed. NOTTINGHAM, Md. If so, you would be entitled to the double pay rate for all time worked over 8 hours on the seventh consecutive day. The New York Department of Labor considers manual workers to include individuals who spend 25% or more of their working time engaged in physical labor. Below are the top ten issues to keep in mind about prevailing wage law. Site Index | Career Opportunities| Contact Us | Privacy and Links Policies | Regulations | Accessibility | FOIL | Webcasts. The main point is to pick something and stick to it, unless there are extenuating circumstances. Make checks payable to The New York Times. Thats how much shell make for her first eight hours, for a total of $80 in compensation. Unvaccinated nurses and other front-line hospital employees face suspensions or potential firings if they dont comply. Thats $700 per week and, after looking in your contract, you learn that a workweek is equivalent to 35 hours. On the 6th day, they work 14 hours, and on the 7th day, they work 10 hours. That last Tuesday just doesnt fit into your normal Monday-to-Monday scheme. Added charges for services are presumed to be gratuities and must be distributed to the employee performing the service unless the charge is clearly identified to the customer as an administrative charge and not a gratuity or tip. The other exception would be if the time worked on the holiday or weekend requires the employee to work more than 40 hours that week. "We have staffing challenges. CALL FOR A FREE CONSULTATION | 877-629-9275 Open Menu Home Our Lawyers Blog Overtime Laws Fill Out the Form Below for a Free Case Review to See If You Have a Claim. What happens in the event that youre not being paid overtime correctly? Shes covered by Californias wage regulations, so her employer will have to calculate overtime wages. Additionally, when a California employee works on seven consecutive days in a workweekregardless of the total number of hours workedthey must be paid double time for any hours worked beyond eight hours on the seventh day. Most hourly employees in New York are entitled to a special overtime pay rate for any hours worked over a total of 40 in a single work week (defined as any seven consecutive work days by the Fair Labor Standards Act). File taxes with no income. Then you calculate all hours worked beyond an eight-hour shift but under a 12-hour shift to determine what must be paid an overtime rate of 1.5 the regular wage rate. Non-exempt employees must receive overtime pay at the rate of 1 times their regular rate of pay for all hours worked over 40 in a workweek. With the Teamsters contract set to expire Aug. 1, pay for part-time workers is a major hurdle. When an employee works on a holiday which is also his or her pass day, the employee is entitled to receive holiday compensation for time worked during regularly scheduled hours and overtime compensation for hours worked in excess of 40 hours within the week. A Guide For Employees, Lawsuit: New Jersey Healthcare Firm Owes Workers Overtime, Break Pay, Department of Labor Releases Updated Guidelines for Paying Tipped Employees, July 24, 2009 Increased from $7.15 to $7.25, December 31, 2013 Increased from $7.25 to $8.00, December 31, 2014 Increased from $8.00 to $8.75, December 31, 2015 Increased from $8.75 to $9.00, $543.75 per week, effective July 24, 2009, $600.00 per week, effective December 31, 2013, $656.25 per week, effective December 31, 2014, $675.00 per week, effective December 31, 2015. Amended tax return. Thats why you should find any double-time pay requirements in your companys employee handbook, rather than research federal labor laws. Find your minimum wage and get your questions answered with fact sheets and dedicated FAQ pages for specific types of workers. No. If you think you have been blocked in error, contact the owner of this site for assistance. If you receive a mailed invoice, you also have the option to pay by check. When calculating double-time and overtime pay rates over a day or week, its easiest to work backward from double-time to daily overtime, to weekly overtime, and then to regular time. What Can I Sue My Employer For?

(1) Part-time employees in overtime eligible positions who render additional service beyond 40 hours during one workweek in the biweekly payroll period are entitled to overtime compensation.

Overtime | SAG-AFTRA Just copy and paste the code below:

New York to Pay $13 Million Over Police Actions at George Floyd Protests When an employee works more than 12 hours in one shift, the time beyond the initial 12 hours is considered double time. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Copyright 2018 Johnson//Becker PLLC, Monheit Law P.C., and Banville Law | Attorney Advertising, Illinois Governor Signs Bill To Increase State Minimum Wage To $15 By 2025, Overtime Pay For Salaried Employees [Infographic], Overtime & Minimum Wage Laws 2018: State By State. In other words, daily overtime, weekly overtime and double-time cannot be calculated twice based on the same hour. Pyramiding of Overtime and Double-time hours is not permitted by California law. The right for non-exempt workers to receive overtime pay under NY labor law cannot be waived or given up by an employer and employee entering into an agreement. To learn more about your rights, feel free to contact our experienced wage and hour attorneys today for a free consultation. The payoff for overtime work appears to be a very good deal for the employee. $152.05 total standbyx .01955new factor to compute 1 x standby for one hour Which occupations are exempt from the overtime pay provisions of the NY State Labor Law? If the employee works more than 1/2 day, he or she would then receive holiday pay for the actual number of hours worked. Real conflict. Truck Drivers: Under the Fair Labor Standards Act, the Motor Carrier Act exemption exempts many truck drivers from receiving overtime pay. Real heart. However, an employer must pay either weekly or daily overtime for the weeks hours that qualify, whichever number is greater. Employees in retail and hospitality positions often do not receive a special holiday rate, as holiday and weekend shifts are part of their normal business hours. The FLSA offers just one piece of guidance on overtime: that employees are due time-and-a-half pay for any time worked over 40 hours in a single workweek. Where an employee is receiving additional payment(s) such as; Location, Geographic, Shift, Inconvenience, Standby for Recall and Hospital Duty Pay, such payment(s) must be included when calculating the overtime rate. What about vacation pay during a holiday? The second chunk of time comes between Lucys eighth and twelfth hours, when shes entitled to the overtime pay rate under California law, but not yet entitled to double time. Executive, administrative or professional workers who earn salaries are often exempt from overtime laws, as well as workers who earn commissions. Access from your area has been temporarily limited for security reasons. The announced hike in OT effective through at least the end of the year comes as the coronavirus mandate for health care workers goes into effect next Monday. It appears that your web browser does not support JavaScript, or you have temporarily disabled scripting.

Working remotely: making the convenience rule work for telecommuting - EY I've remained with the same employer (which has California and New York offices). It appears that your web browser does not support JavaScript, or you have temporarily disabled scripting. Otherwise, it may look as though you are tampering with the workday and workweek to try to reduce overtime and double-time owed, for which you can be cited and fined. That will be the 6th and 7th shifts worked. A large part of the rate increase is driven by taxes, most notably City of New York property taxes, which are now $1.9 billion as of financial year 20192020 and continue to increase every year, the company noted on its website.. Therefore, overtime hours for all non-exempt workers are now any hours worked over 40 in a payroll week. For the second example, well involve daily and weekly overtime as well as double-time, in order to show you how to keep it all separate. Even if you arent required to pay double time, you may choose to do so as an incentive for hours worked over a certain number, for hours after a number of consecutive shifts, or for holidays. Exclusions (exemptions) from the overtime pay regulations follow the federal Fair Labor Standards Act (FLSA). About form 1099-K. Small business taxes. Common Violations of New York Overtime Laws The coffee plantation's slaves had been "reduced to 40 by death . New York States health care heroes have worked tirelessly and put their lives on the line throughout this terrible pandemic, and they should be compensated properly for their efforts, Hochul said. Outside of California, the overtime pay rate is always time-and-a-half, or 1.5 times your regular rate of pay. Double time is a type of overtime pay rate where the employer pays an employee twice their normal rate. In addition, many employers in states without double-time laws choose to observe rules for double time within their organization to compensate workers for their willingness to put in long hours or to fill undesirable shifts. NOTE: Since standby on-call and hospital duty pay must be included when calculating overtime, these payments must be reported on the same payroll submission cycle as overtime to avoid retroactive adjustments at a later date. Over 7,000 workers from those facilities will be eligible for the changes. $632.6 million Jan. 5, 2022 .

New Yorkers will pay double for Con Ed gas, electricity by 2025 and New York City has agreed to pay more than $13 million to settle a civil rights lawsuit brought on behalf of roughly .

Ten Things to Know about Prevailing Wage Law in New York Under New York state labor regulations, this minimum salary for the Executive & Administrative exemptions has been raised, inclusive of eligible wage allowances (i.e., board, lodging, facilities, etc.) Effective Sep. 26, 2018 - $85,301. SUNY Chancellor Jim Malatras said the OT boost will help with staff retention at the hospitals. GET to KnowNew York State ComptrollerThomas P. DiNapoli. An employee whose pass day is other than the holiday, and who normally works on the day on which such holiday falls, as part of his or her work week, would be entitled to holiday pay for such service, but would not receive overtime compensation for that day. Agencies submitting overtime for part-time employees must explain the payment in General Comments. SPECIAL CASE: OVERTIME RULES ON A FILM SET What is the federal overtime law? The State of New York, its officers, employees, and/or agents are not liable to you, or to third parties, for damages or losses of any kind arising out of, or in connection with, the use or performance of such information. Must be given at least a 60 minute break for a noonday meal. Connecticut recently introduced a limited convenience rule, beginning in tax year 2019.

Where an employee has received payment of a Longevity Lump Sum Payment, the payment is considered part of total annual salary for overtime compensation for a one year period from the authorized payment date.

Pay Rate Calculator - OPA - NYC.gov If you rely on information obtained from Google Translate, you do so at your own risk.

Apple Pay can double-charge commuters who use MTA's OMNY - ABC7 New York

Koln Vs Bochum Leaguelane,

What Are The 7 Symptoms Of A Sociopath,

Purvis Baseball Maxpreps,

Unc Football Schedule 2028,

Articles N